When One Care Event Impacts Three Generations

Carroll Golden - Retirement Strategist

Why Retirement Planning Must Connect Health, Wealth—and Family

There’s a common myth in retirement planning: that health and wealth are separate conversations.

They’re not.

They’re intertwined—especially when a care event hits.

One unexpected care need—an aging parent’s fall, a stroke, cognitive decline—can quietly disrupt three generations of financial security:

The person who needs care.

The adult child who steps in.

The grandchild whose future plans shift as a result.

This isn’t just theoretical. It’s happening every day.

Generation One: The Retiree or Aging Parent

They’ve saved diligently. But their Medicare plan doesn’t cover in-home care. Or their long-term care policy lapsed. Or they thought family would “figure it out.”

Suddenly, assets meant to last 25 years are redirected to 24/7 support.

Retirement becomes a stressor instead of a safety net.

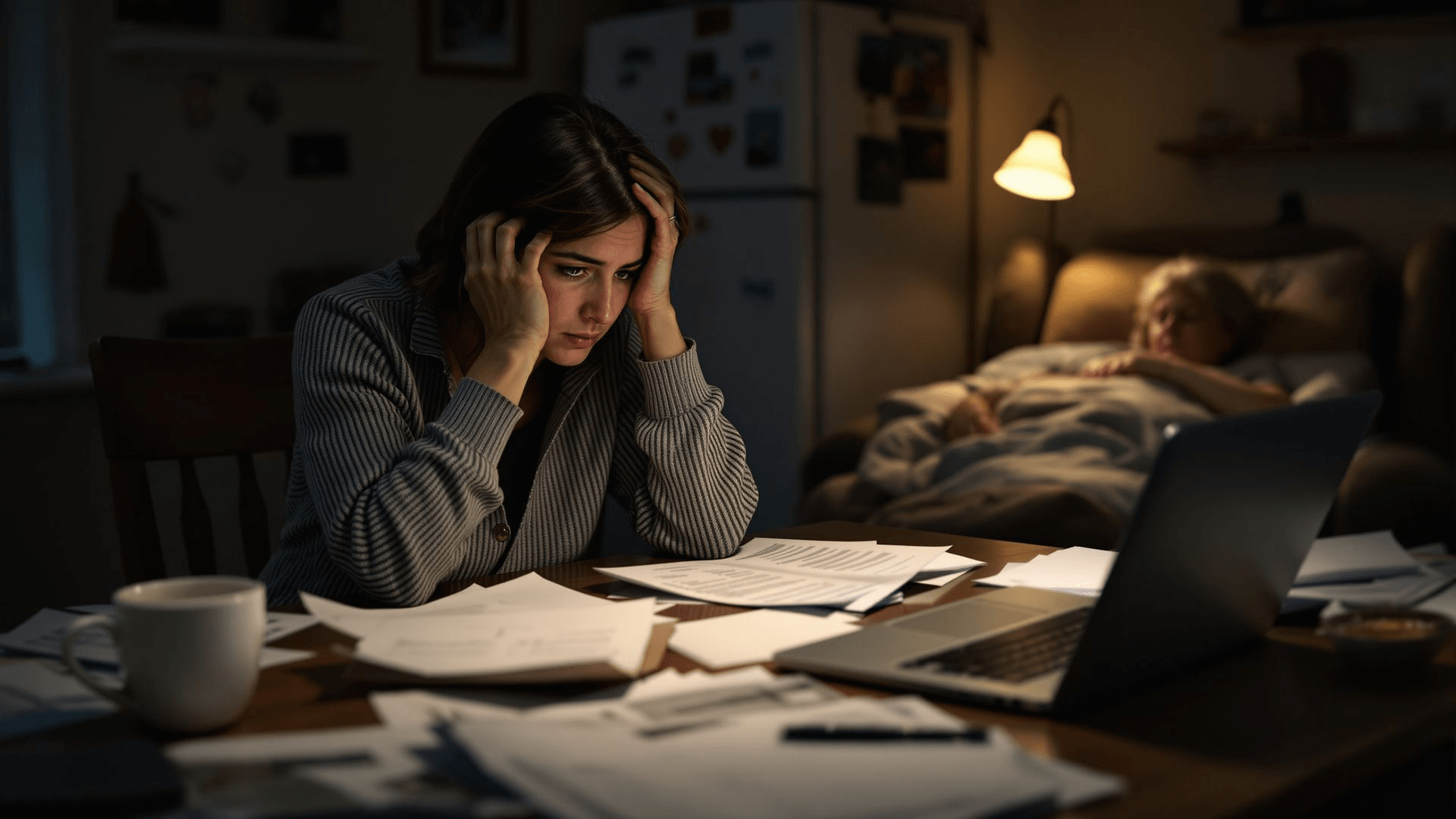

Generation Two: The Adult Child

Enter the caregiver—often a daughter balancing work, kids, and aging parents.

She reduces hours at work.

She dips into savings.

She puts her own retirement contributions on pause.

Not out of obligation, but out of love.

And over time, the cost compounds.

Generation Three: The Grandchildren

The ripple effect reaches college funds.

Inheritance plans.

Down payments.

Even emotional bandwidth.

Financial decisions start being made not from strategy, but from strain.

This Is Why Longevity Planning Matters

A single care event isn’t just a medical moment.

It’s a financial turning point—one that touches every corner of a family tree.

That’s why the strongest retirement plans today go beyond income and investments.

They include:

Long-term care planning

Family conversations about roles and boundaries

Insurance strategies—or intentional self-funding

Housing preferences

Advance directives and healthcare proxies

Contingency planning for caregivers

Here’s What You Can Do Right Now

Download our Long-Term Care Planning Worksheet to start thinking ahead.

Talk to your family—not just about what you want, but what you don’t want them to carry alone.

If you’re already in the caregiving role, bring your advisor into the conversation. Planning can still happen—even in motion.

A single care event can drain savings. Delay retirements. Redirect futures.

But with proactive planning, that same event can become manageable—not catastrophic.

You can preserve not just your wealth, but your relationships, your dignity, and your family's future.

That’s not just smart planning.

That’s leading your family forward.

📘 This blog builds on themes from my book, Leading in a New Retirement Era: How to Lead, Adapt, and Win in an AI-Driven World. It’s not about creating a one-size-fits-all retirement—it’s about understanding your influences, your finances, and your future so your plan is truly yours.

Disclaimer: This material does not constitute tax, legal, investment, or accounting advice and is not intended for use by a taxpayer for the purposes of avoiding any IRS penalty. Comments on taxation are based on tax law current as of the time this article was produced.